2022 was a great year of humbling for bitcoin miners of all sizes. We saw industrial-scale miners go belly up and get bailed out, while (we) small-scale miners stood in the trenches seeking efficiency wherever it could be found, even if that meant radically reducing hashrate. This short article shows a small window in market conditions, The Firmware Triangle, that is where it makes sense to nearly ½ your hashrate in order to find profitability.

In 2022, operators did not have a ton of options regarding efficiency. You simply ran the numbers and purchased the miner with the factory settings that met your goals. But 2022 brought many ways to find efficiency. We saw immersion cooled home platforms make it to mainstream, Bitmain and MicroBT release forked visions of the future of mining with Bitmain releasing for modular closed loop water cooled platform and MicroBT dropping a hotrod immersion cooled ASIC.

The most notable improvements came from firmware (FW) developers. Newish entrant Vnish was first to market with FW for the S19j series miner which provided a GUI to easily increase overclock (increase the power consumption and th/s output). The GUI and bits have received many upgrades over the past year, it is a very nice platform.

Later in 2022, we saw the much anticipated FW release for the Antminer S19j Pro from Braiins. They’ve made a name for themselves for their insane performance improvements on the previous Bitmain platforms, and they brought similar gains to the new platform.

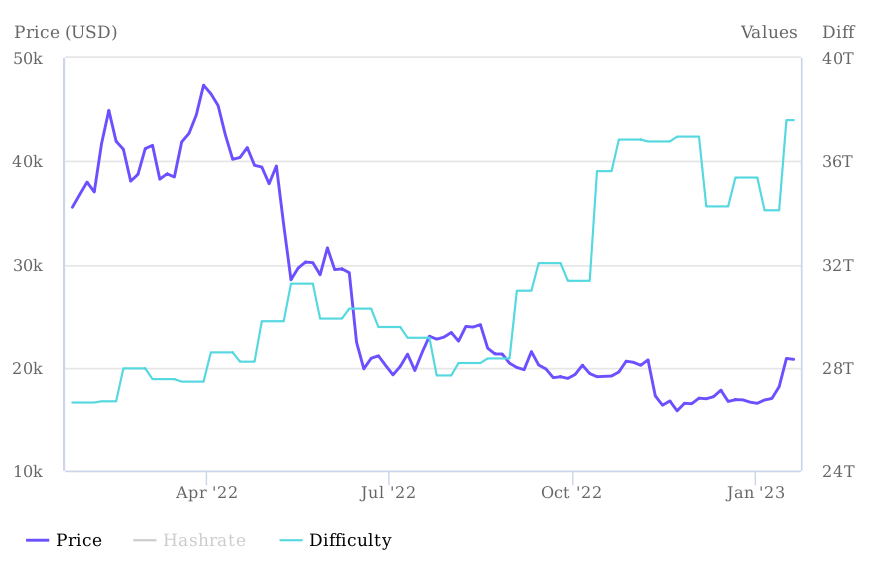

Besides the hardware and software developments in 2022, this chart best summarizes WTF happened. You see price and hashrate inversely correlated. TLDR is this… REKT, CARNAGE, BLOOD IN THE STREET. Mining difficulty increased and BTCUSD decreased. Miners got fucked, hard.

Survival

That brings us to the point of this whole piece, the Firmware Triangle. How can a miner survive in these market conditions? As a small scale miner ( <10 petahash) you don’t have the luxury of a team of techs or devs standing by to service your fleet or run the numbers. It is on you to do both. We signed up for this.

In building my small farm, I chose to standardize on the Bitmain Antminer S19j Pro 96T. I did this in order to have interoperable parts and because at the time I heard Braiins was developing FW. Thankfully Braiins did release FW in 2022 which unlocked significant performance and efficiencies.

Performance Settings for S19j Pro 96T on BraiinsOS+

| ASIC | TH/s | Watts |

| S19j Pro 96T Underclocked FW | 60 | 1,600 |

| S19j Pro 96T Factory FW | 96 | 2,950 |

| S19j Pro 96T Overclocked FW | 105 | 3,100 |

The sample above is based on averages of my farm which is located in an enterprise class datacenter in Dallas. It has very clean and cool air and smooth electricity. It was remarkable to install the FW and watch the fleet self tune. It makes you wonder why ASIC manufacturers do not open the full potential of the silicon and they (attempt to) lock them down.

When I first installed Braiins, the OBVIOUS first thing I did was crank up the watts and see how many more TH/s I could get. Admittedly, it was pretty awesome to get the performance of a S19j Pro 104T machine out of a 96T machine, and not have to pay for it (besides the Braiins dev fee). As the market conditions for miners continued to worsen throughout 2022, like everyone else, I tried to find profitability where I could. I cranked the watts up across the farm and saw personal all time highs for hashrate. Yet the market continued to worsen and thanks to Adam O aka Denver Bitcoin I considered the unthinkable… what would happen if I underclocked?

The Firmware Triangle

I wanted to understand if there is a scenario in which Underclocked FW (lowering the wattage and TH/s) would be more profitable than running Factory FW or Overclocked FW. I thought there would be no scenario where underclocking to 57% of total hashrate would make more money than overclocking.

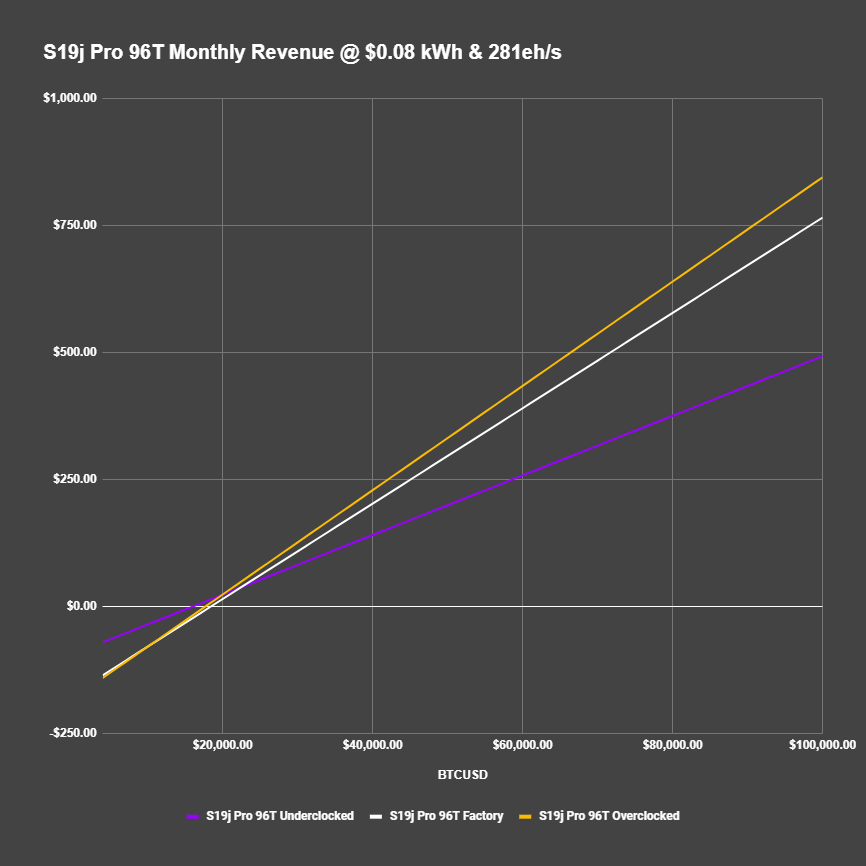

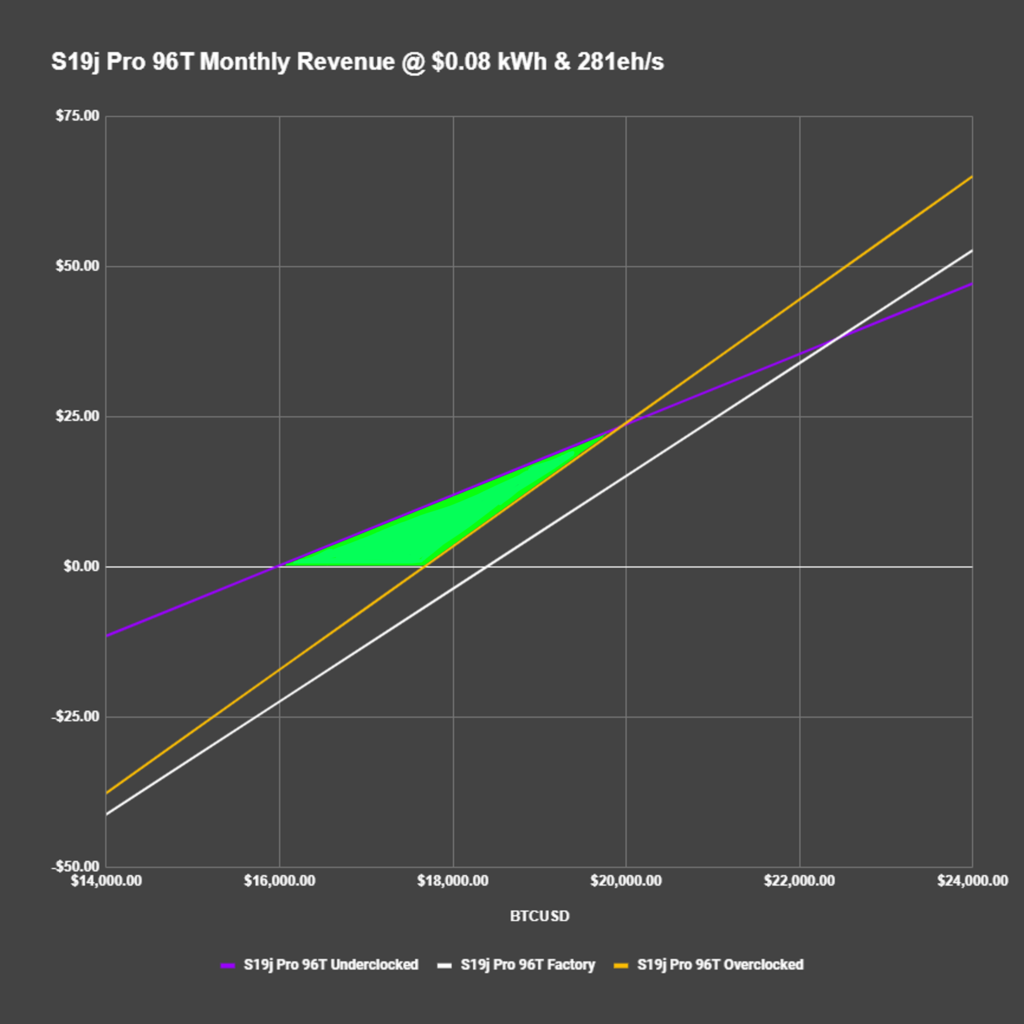

This chart shows us how the profitability of the three FW settings based on current difficulty and power rate at different BTCUSD prices. As you can see, the Underclocked FW vastly underperforms the Factory FW and Overclocked FW. You are getting less th/s so this makes sense. The big takeaway is that as price increases, you want to run Overclock FW in a serious way.

But let’s zoom into today’s prices, the $15k-$21k zone. Things look way more interesting down there.

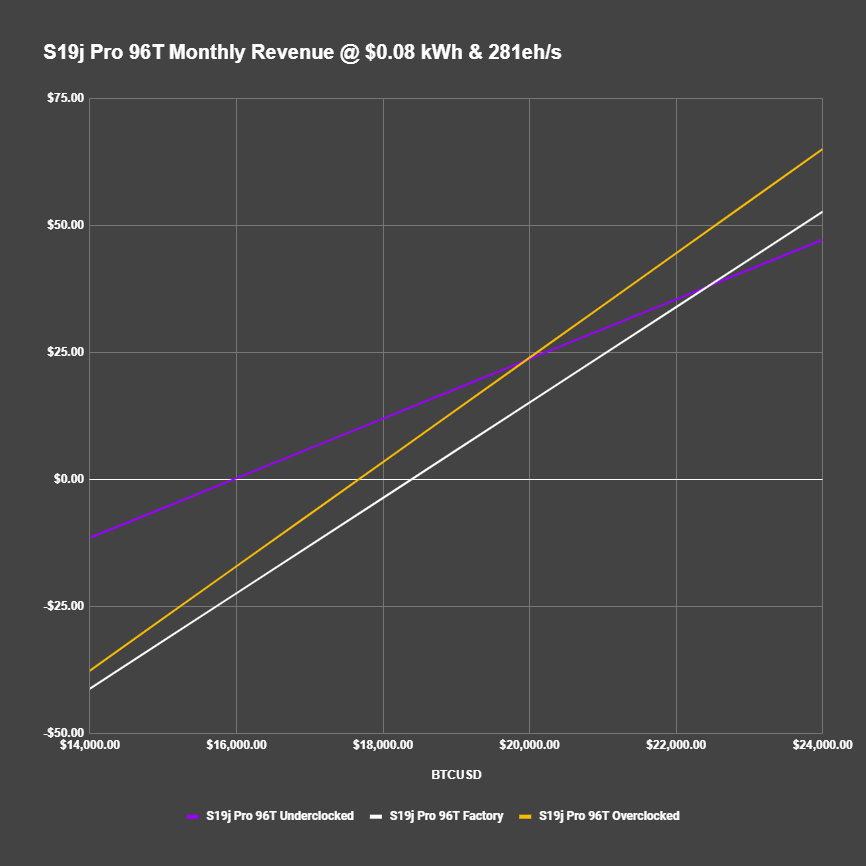

Do you see what I am seeing? Yes, a scenario where it makes sense to reduce your hashrate 42% in order to make MORE sats. You can see a small range where Underclocked FW outperforms both Factory FW and Overclocked FW. It is a small window but it is there and more importantly, we are literally in this range right now, and have been for some time. This is The Firmware Triangle.

Here’s what it looks like on a table, you can see at what BTCUSD each FW becomes profitable and more.

Running Underclocked FW you see profitability at a lower BTCUSD price than both Factory and Overclocked FW, but Overclocked FW quickly becomes the path to profitability. Essentially, Factory FW is never the path to profitability when all three options are present. Considering how painful the past year has been for miners (me), this small triangle of hope is just what I needed.

My last learning from 2022 to share is that energy cost is the most important variable above all else. Even S9’s are profitable, if you have near free energy. Be diligent in understanding your rates. Inspect your contracts. Seek cheaper power. Your model must include 80% drawdown in BTCUSD and doubling hashrate. If you can’t mine profitably in those circumstances, stick to stacking sats.