Over the past couple of weeks, several friends have asked me about buying an ASIC. They have been casually watching the markets and are seeing the price of machines begin to fall. Typically, ASIC prices lag behind BTC price adjustments by 3-4 weeks, especially when the price falls. When prices rise, ASIC distributors are much quicker to increase prices. There’s no easy answer to the question because the age-old response applies… IT DEPENDS! But fear not, I have some data points1 to share and I do have my two sats to add.

Now looking at the USD prices of bitcoin and the S19j Pro, you can see significant discounts since January 1, 2022.

| Asset | Price On January 1, 2022 | Price On May 24, 2022 | Price Change |

| BTC | $47,560 | $29,000 | -40% |

| S19j Pro 96t | $9,600 | $6,480 | -32% |

If you were interested in buying your first modern ASIC or adding to your existing hash power, then this is really great news. I mean, who can argue with 46% off all-time high prices for an ASIC?

This would be the end of the story if you were a “middle of the bell curve” soy. But you aren’t. You are a savage. We use sats as our unit of account around here. We run the numbers2.

What does that same chart look like if you price the ASIC in sats?

| Asset | Price On January 1, 2022 | Price On May 24, 2022 | Price Change |

| BTC | $47,560 | $29,000 | -40% |

| S19j Pro 96t | 0.20374379 BTC | 0.22167488 BTC | +8% |

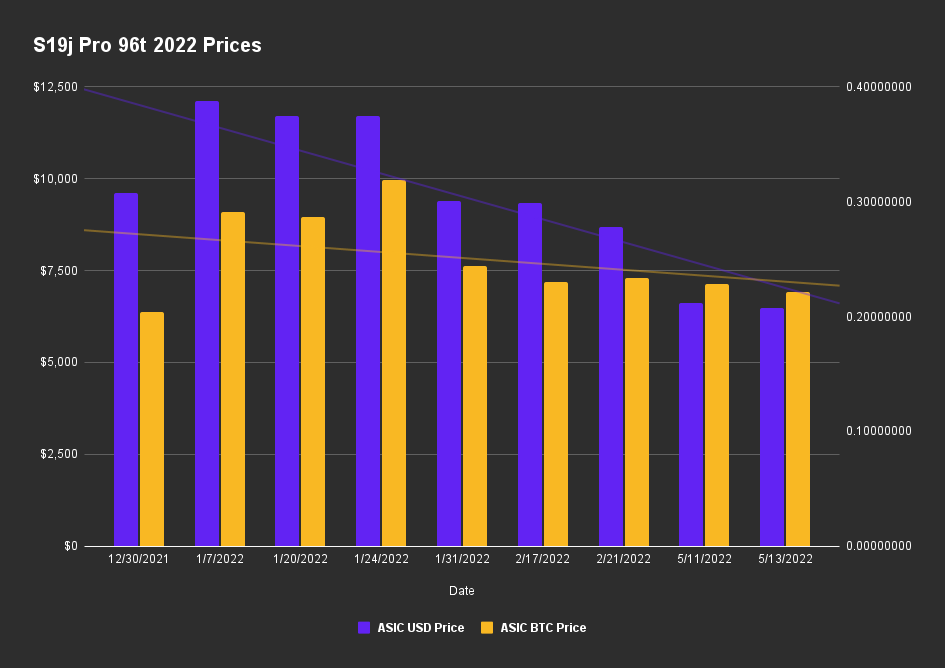

What’s even wilder is to look at the S19j Pro 96t over time. These are all the posting prices from Kaboomracks in 2022 for the S19j Pro 96t.

You can see the trendline for ASIC price in USD falling at a much more significant pace than the ASIC price in BTC. In fact, you can see that the ASIC price in BTC terms has flatlined over the last four entries. Another slight note on this chart is the lack of data between 2-21-2022 and 5-11-2022. That is a big gap. This means either no S19j Pro 96t ASICs were posted on Kaboomracks or the other sights I follow OR I missed the postings. Regardless, this paints a wild picture. We are at a higher price point in BTC than we were on January 1, 2022.

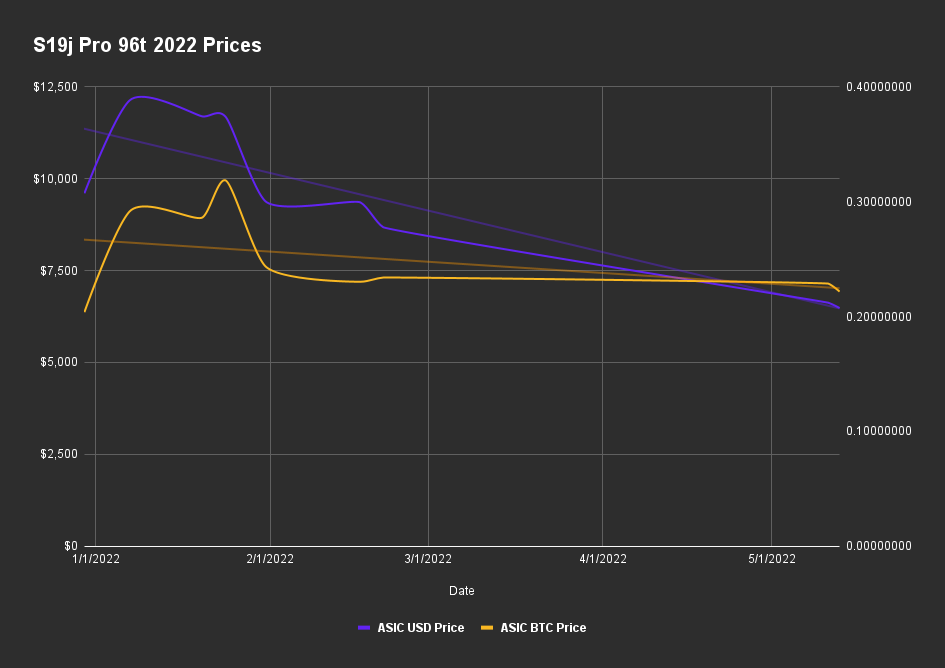

I like this line chart as an illustration because it better shows prices across time. The ASIC flat line price in BTC is wild. Current prices make me feel like we should see S19j Pro @ 14m sats or $4,200, which would be around a 30% discount off the current 20m sats price.

Final 2 Sats

I am still 💯 bullish on Bitcoin, bitcoin, and bitcoin mining. I am a buyer. The thing is, I believe at this moment you are better off stacking sats instead of stacking hash. ASICs are NOT ON SALE in BTC terms. As a very small scale miner, I understand what I am up against, that is industrial-scale miners with access to disturbingly cheap capital and who are able to access very very cheap debt. They are not selling BTC for ASICs. They are taking on debt to stack hash. Right now the power play for the small guy is to stay humble and stack sats.

“…We should see S19j Pro @ 14m sats or $4,200, which would be around a 30% discount off the current 20m sats price.”

– Hood Mining

Even if I had access to crazy cheap money right now, I would have a hard time stacking hash because the opportunity cost for sats is so low.

References

- 1. Since January 1, 2022, I have been tracking ASIC prices from a couple of vendors. Hood is standardized on Bitmain S19j Pro 96t model, so I am most familiar with the price and the model in general and will use that as the benchmark in this post. ↩

- 2.Here is the data table where I have been tracking the ASIC prices. I have only been tracking Bitmain and MicroBT because that is all I am interested in. You will see a shit ton of columns in the data table. Good luck. ↩